Bitcoin is one of the year’s hottest topics, especially in the past month. In the past week alone, its price in United States Dollars has risen upwards of $5,000 – a truly astounding rise. Despite all cryptocurrencies’ volatility and mystery associated with them, pseudonymous Satoshi Nakamoto’s advent of Bitcoin and its blockchain.

image source: here

Simply put, the blockchain is essential to the fields of banking and finance of future years’ coming. Let’s first define how Bitcoin works, what the blockchain is, and why it’s slated to be instrumental to financial transactions of the future.

What Is Bitcoin, And How Does It Work?

Bitcoin is a cryptocurrency – essentially a currency that uses encryption techniques to generate new units, verify current transactions, and operate without the oversight of government-backed central banks – that can function as both a currency, money with standardized values used to pay for goods and services, and an investment, or money set aside today to (hopefully) earn money in coming days, weeks, and months, but mostly in periods of years.

Rather than traditional fiat currency – aka paper and metal money used by every country on planet earth – cryptocurrency are digital lines of code that equate to equalized items of value.

Although Bitcoin isn’t totally anonymous, one of its initially-desired central features was its ability to keep users free of being identified. Another sought-after feature setting the cryptocurrency apart from traditional forms of currency is its ability to operate without a central bank’s regulation.

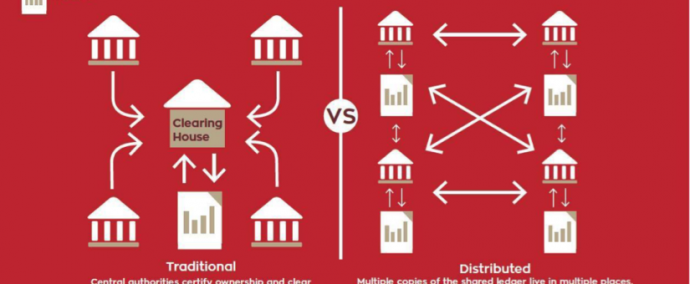

The record of all bitcoin transactions is held on a blockchain, made of up hashes, or short bits of data that identify them. Bitcoin’s blockchain is a database of all transactions, the most important identifying factor of which is its ability to be inspected by anyone, anywhere, at any time.

Blockchains are – as their name suggests – links of blocks, or groupings of transaction verifications.

Major Benefits Of Blockchain Technology

In today’s world, anyone paying back, for example, providers of title loans in Nampa could fork over fake, ill-gotten, or otherwise dirty money to financial institutions serving such loans. The source of paper money is virtually impossible to track. However, Bitcoin and other cryptocurrencies using blockchain technologies are, in fact, able to track and verify.

Because fiat currency can’t be tracked, it’s likely to succumb to the many benefits of Bitcoin and altcoins – short for “alternative coins,” or cryptocurrencies other than Bitcoin – in coming years. Further, cryptocurrencies don’t require the regulation of government bodies and central banks, meaning Bitcoin and altcoins can operate in the interest of the world at large, rather than “talking heads” atop wealthy corporations and governmental bodies that could very well act according to their own, personal, private intrests, rather than the welfare of mankind.

Contracts Of Today And Smart Contracts

Contracts of today are far from ideal. In many cases, parties can’t verify the validity of contracts signed in agreements, making agreed-upon results and penalties resulting from failing to adhere to terms difficult to enforce.

Smart contracts are contracts that utilize blockchain technology to make agreements and their many terms available to everyone around the world. This ensures parties can’t fudge up the contents of contracts, making contracts of the future many times better than contract law of today’s world.